Bipartisan push to revoke Biden administration's ESG rule

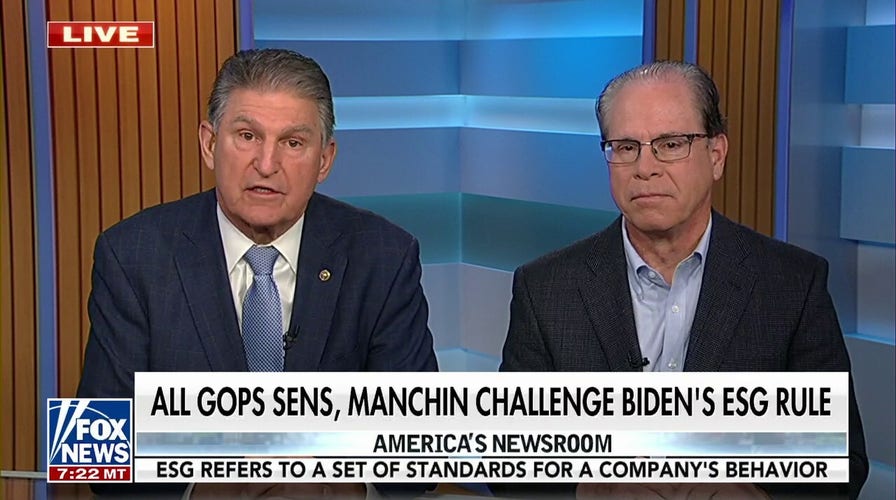

Sen. Joe Manchin, D-W. Va., and Sen. Mike Braun, R-Ind., joined 'America's Newsroom' to discuss the push to take politics out of investing and the latest over national debt negotiations.

House Republicans will vote on legislation next week to kill the Biden administration’s controversial rule that allows private retirement plan fiduciaries to consider environment, social and governance (ESG) factors when making investment decisions for their clients.

The Department of Labor’s controversial rule, which took effect in February, has been derided by Republicans and dozens of trade associations as an effort to impose a social agenda on the more than 140 million Americans whose retirement plans are governed by standards set by the federal government.

For decades, those standards have said investment decisions must be guided by the goal of maximizing the return on those investments. However, the rule from Biden’s Labor Department said investment plan fiduciaries can consider companies that prioritize climate change and other social issues as they invest.

OVER 100 GROUPS BACK MANCHIN, GOP PLAN TO BLOCK BIDEN'S ‘WOKE’ ESG INVESTING RULE

House Republicans, led by House Speaker Kevin McCarthy, R-Calif., are calling up a bill next week to kill a controversial ESG investing rule that took effect this month. (AP Photo/Andrew Harnik)

House Republicans will use the Congressional Review Act next week to try and stop Biden’s ESG rule. That law lets Congress reject any federal rule if the House and Senate can pass a resolution that says Congress disapproves of it.

Rep. Andy Barr, R-Ky., introduced a resolution to that effect in early February, and the House Rules Committee is scheduled to meet on Monday to set that resolution up for a vote on the House floor as early as Tuesday.

"Retirement plans should be solely focused on delivering maximum returns, not advancing a political agenda," Barr said this month when he introduced the measure. "If Congress doesn’t block the Department of Labor’s rule greenlighting ESG investing in retirement plans, retirees will suffer diminished returns on the investment of their hard-earned money."

The bill from Rep. Andy Barr, R-Ky., would kill a rule that opponents say tries to impose "woke" investment goals on the retirement accounts of millions of Americans. (Ting Shen/Pool via REUTERS)

In early February, more than 100 groups organized by Advancing American Freedom (AAF), former Vice President Mike Pence’s political advocacy group, called on Congress to roll back the ESG rule. Groups on the letter included Heritage Action, America First Policy Institute, Americans for Prosperity, Americans for Tax Reform, Climate Science Coalition of America, Club for Growth, Fair Energy Foundation, Faith & Freedom Coalition and the Foundation for Government Accountability.

"The woke capital agenda of the Biden administration needs to be cast aside for commonsense policies that protect American retirees," AAF founder Pence told Fox News Digital. "The American people deserve accountability for their hard-earned savings and reassurance that the encroaching of ESG is overturned."

The Labor Department has defended its decision to allow retirement plan managers to consider investing in companies that are "committed to positive environmental, social and governance actions." While the Labor Department acknowledges those goals are not aimed at maximizing returns, the department also insists that the rule change would help plan fiduciaries "safeguard the savings of America's workers" by allowing ESG-based investment decisions.

25 STATES HIT BIDEN ADMIN WITH LAWSUIT OVER CLIMATE ACTION TARGETING AMERICANS' RETIREMENT SAVINGS

The Department of Labor, led by Secretary Marty Walsh, says the rule will ‘safeguard’ retirement accounts by letting plan fiduciaries consider ESG factors. (Tom Williams)

House passage of the bill disapproving of the ESG is all but assured in the GOP-led House, and while it is not clear Democrat leaders in the Senate will take it up, the bill is supported by at least half of the upper chamber. In early February, all 49 Republican senators and Sen. Joe Manchin, D-W.Va., proposed a Senate version of Barr’s legislation.

Sen. Mike Braun, R-Ind., said when he introduced the bill that "the last thing we should do is encourage fiduciaries to make decisions with a lower rate of return for purely ideological reasons."

CLICK HERE TO GET THE FOX NEWS APP

"I’m proud to join this bipartisan resolution to prevent the proposed ESG rule from endangering retirement incomes and protect the hard-earned savings of American families," Manchin said.

Fox News Digital's Kelly Laco contributed to this report.